It is not possible to consistently time the sectoral winners and there may be prolonged cycle of outperformance and under performance. Furthermore, there may be a good company in an under-performing sector and an average...

Read moreDifferent Styles of Investing yield different results in the different market cycles. Sometimes it is Value that outperforms Growth and sometimes momentum is more apt than low volaitility style. The Data is colated for c...

Read moreLinearity is not the characterstic of Markets. Different Market Caps ( Large- Mid and Small) have generated different returns in different time year. The Data is of Calendar Year representing January to December period....

Read more

ICICI Pru Mutual Fund comes out with valuation index every month end over two main asset classes Equity and Debt . Lets Have Closer look at them....

Read more

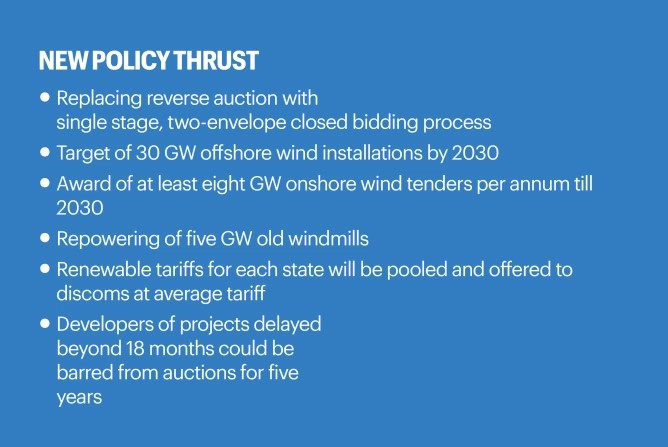

India intends to produce half the energy from renewable souces by 2030 as per PM Modi's commitment at COP26 Summit in Glasgow....

Read moreThe US Federal Reserve has decided to pause its series of interest rate increases after raising rates for 10 consecutive times. However, they have indicated that if the economy and inflation don't cool down, they may rai...

Read moreThe MSCI India Index represents the performance of large and mid-cap segments of the Indian equity market....

Read moreWith RBI maintaining liquidity stance as "withdrawal of accommodation", guiding 4% inflation target and with monsoon getting delayed, a rate cut looks unlikely anytime soon....

Read moreMacro date points affects the asset prices. It is important to keep track of them-...

Read moreThe company is India’s leading business services provider and largest private-sector employer. It offers a host of services to help organizations manage their non-core activities in the areas of Workforce Management, O...

Read moreThe Rating Watch Negative reflects increased political partisanship that is hindering reaching a solution to raise or suspend the debt limit despite the fast-approaching x-date,” the X date can arrive as early as June ...

Read moreAIA Engineering , Mrs. Bector Foods, Emami, Expleo Solutions, GMM Pfaudler, India Energy Exchange, HBL Power Systems,...

Read moreMTAR Technologies Limited (MlL) is an Indian company that specializes in precision engineering and manufacturing of critical assemblies for various industries, including nuclear, clean energy, space, and defense. The com...

Read moreGNA Axles is Punjab based manufacturers of rear axle shafts, other shafts and spindles used in on-highway and off-highway vehicular segments in India. The company is mainly engaged in manufactures and sells auto componen...

Read moreState Bank of India (SBI) reported a 83 per cent jump in standalone net profit at Rs 16,694.51 crore in the fourth quarter of 2022-23 against Rs 9,113.53 crore a year ago, beating analyst estimates....

Read moreContinued strong momentum was seen in the "Tendering and Awarding" activity in the beginning of FY24 for April. And with improved incentives and outlay, the government aimsto push local manufacturing of IT hardwaresuch a...

Read moreThe defense sector in India has been thriving for several reasons, including: Increased defense spending: Over the last few years, the Indian government has been increasing its defense spending to modernize its armed fo...

Read moreResults season is on and the major names who would be coming out with the announcements today....

Read moreRedington Limited, an integrated technology solutions provider and a Fortune 500 company, enables businesses in their digital transformation journeys by addressing technology friction – the gap between innovation and a...

Read moreValuations multiple of traditional sectors like metals, mining, public sector enterprises, public banks have been rising and reverting back to mean.Technology and IT sector valuation multiples have been under lot of stre...

Read more